Businesses are often faced with the challenge of choosing the right jurisdiction to establish their business, considering the diverse legal frameworks of some 200 sovereign states around the world. At Manimama Law Firm, we specialize in advising companies on choosing the right place of formation for their specific business. Through in-depth research and analysis, we identify countries that offer flexible corporate laws, giving companies significant autonomy to create an organizational structure that aligns with their goals and priorities.

Whether your business operates in a traditional onshore environment or needs the benefits of an offshore jurisdiction, our team of lawyers has the knowledge and experience to assist you. From understanding regulatory requirements to assisting with legal documentation and compliance, we are committed to providing comprehensive and customized services to meet your company’s needs.

Company registration is the process of formalizing the status of a legal entity in accordance with the laws of a certain country. During this process, the company is officially recognized as a legal entity with its own legal capacity. To receive this status, it is necessary to provide certain documentation and fulfill the requirements established by the state authorities. Due to registration, the entity is able to conduct commercial activities, conclude contracts, participate in court proceedings and perform other legally significant actions.

How to choose a jurisdiction for a company:

Selecting the right jurisdiction is an important step when registering a company. Our company provides all the necessary services and advice to help clients make the appropriate decision:

- Clients describe their business goals and expectations, which helps us identify the most suitable jurisdiction for their company. We also analyze such factors as tax incentives, business legislation and the level of government support.

- We provide a thorough understanding of the tax and legal peculiarities of particular jurisdictions, which helps clients make an informed choice based on their unique needs and development strategies.

- During our work, we take into account such factors that affect the business environment as the level of competition, access to financial and human resources, as well as opportunities for further growth and development in different jurisdictions.

We are dedicated to helping our clients not only choose the right jurisdiction, but also create a strategic framework for the successful operation and development of their business in the long term.

Learn about the specifics of particular jurisdictions here:

Most popular

Lithuania

Poland

Canada

Estonia

BVI

Wyoming

Singapore

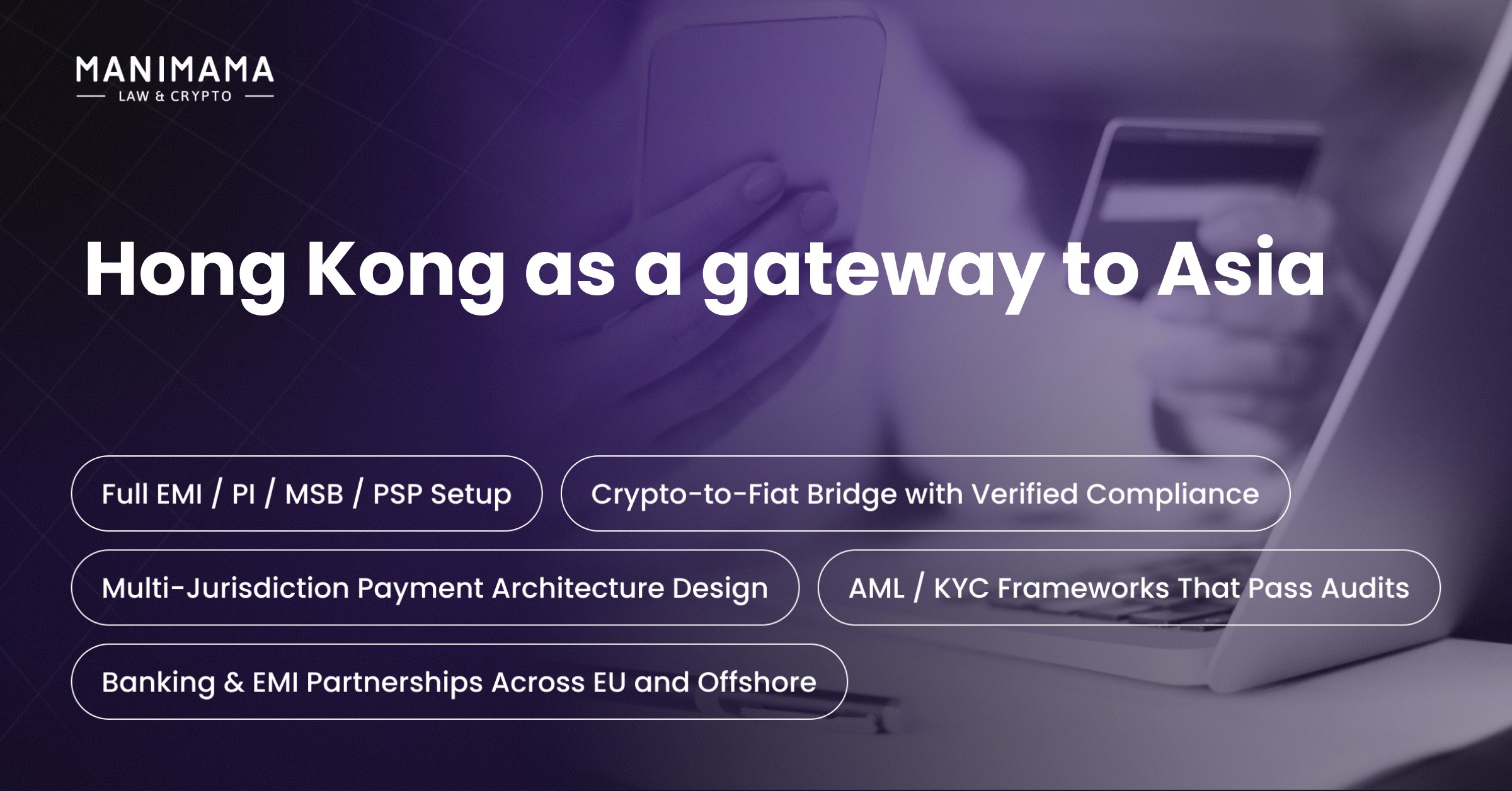

Hong Kong

UAE

Fastest registration

BVI

Ireland

Anguilla

Cayman Islands

Grenada

St. Lucia

Ras Al Khaimah (UAE)

Samoa

Vanuatu

No taxation

BVI

Delaware

Wyoming

Florida

Cayman Islands

Gibraltar

Anguilla

Bahamas

Bermuda

Belize

Panama

St. Kitts and Nevis

St. Vincent and the Grenadines

Bahrain

Labuan (Malaysia)

Mauritius

Seychelles

Marshall Islands

Samoa

Vanuatu

No requirement for share capital

Cyprus

Gibraltar

Anguilla

Bahamas

Bermuda

Belize

BVI

Cayman Islands

Delaware

Wyoming

Florida

Choose your country for more information:

Ganna Voievodina

Manimama

|

CEO

“Incorporation of a company is integral to the legal protection of a business, providing its owners with a legal identity separate from their personal finances and liabilities. It also enforces compliance with legislation and tax obligations, which reduces risks to the business and the owners. So if you are interested in registering your business legally, then contact us for help”.

Benefits of registering a company

Separate legal entity

Companies have a separate legal status that allows owners to protect their personal assets

Tax privileges

There may be tax benefits for incorporated companies depending on the jurisdiction, such as lower corporate tax rates or entitlement to certain deductions and exemptions

Attracting talent

It is easier for a registered company to attract and retain highly skilled staff and partners due to its status and growth prospects

Access to new technologies and resources

Numerous countries provide registered entities with access to new technologies, innovations and resources through various export and international development support programs

Value growth

Incorporation helps to increase its market value and attractiveness to potential investors or when selling the business

Diversification

Incorporation provides opportunities for business expansion, including opening branches, operating abroad and participating in international projects

Key numbers about incorporations

€1minimum share capital for company in many countries | 2 daysthe potential speed of incorporation in certain countries | 25%possible tax optimization impact for freelancers |

~1Mcompanies were opened in the UK in 2023 | 82%of EU Companies are Microenterprises | ~23,5Mcompanies were operated across EU in 2022 |

Company registration process

Company registration is a core step in creating a legal entity to conduct business. The procedure involves officially registering the business with the relevant state authorities, thereby providing it with legal recognition.

The procedure for registration differs depending on the type of company structure chosen, such as sole proprietorship, partnership, limited liability company, joint stock company etc.

Hence, there are a number of actions to be taken during the formation of a company to ensure compliance with legal and regulatory requirements. These actions typically include:

- Choosing a company name

- Determining the company structure and form of ownership

- Collecting the necessary documents from the client

- Preparing and filing the incorporation documents

- Obtaining necessary licenses and permits

- Fulfillment of tax obligations and reporting

Types of company structures

There are different types of company structures in business, each designed to meet different needs and goals. Keeping an understanding of these structures is critical for entrepreneurs and business owners because it affects factors such as liability, taxation, management, and fundraising.

Here is a closer look at some of the legal forms of business entities:

Sole Proprietorship

This is the simplest form of business structure in which one person owns and operates a company. There is no legal distinction between the owner and the business entity in sole proprietorship. The owner has complete control over business decisions and keeps all profits, but is fully responsible for any debts and liabilities incurred by the entity. This type of business structure is simple and inexpensive to set up, and requires minimal formalities compared to other business entities.

But one of the significant disadvantages of a sole proprietorship is that the owner has unlimited personal liability, meaning that his or her personal assets are at risk in the event of debts or lawsuits. Furthermore, sole proprietorships can be difficult to raise capital or investors due to the owner’s limited financial resources.

Limited Liability Company

This is a legal entity that exists separately from its owners, known as members. One of the key advantages of a limited liability company is the limited liability protection it provides to its members. Meaning that if the entity incurs debts or legal liabilities, the personal assets of the members are generally protected from creditors and business-related lawsuits.

As for the disadvantages, these are the formalities required to operate, the possibility of disagreements between members, and the limited ability to raise capital compared to corporations.

Joint Stock Company

It is a type of legal entity in which ownership is divided into shares. This ownership structure makes it possible to pool the capital of several shareholders. The profits earned by the firm are distributed among the shareholders in the form of dividends depending on the number of shares they own.

Among the main advantages of a joint stock company is limited liability, which means that shareholders are not personally liable for the debts and obligations of the entity. This stimulates capital inflow by spreading risk among shareholders and attracting capital from a wide range of investors.

Partnership

It is a type of business structure in which two or more people, called partners, come together to conduct business for profit. Partnerships are a popular form of business organization for small businesses and professional practices like law, accounting, and medical firms.

There are different types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships, each with its own characteristics and legal implications.

In general, partnerships offer benefits such as shared decision-making, management flexibility, and simplified tax reporting, making them in demand for businesses with multiple owners who want to collaborate and share resources. Partners should, however, be mindful of the potential risks associated with unlimited liability and the importance of a well-drafted partnership agreement.

What Manimama can offer you

Our law firm consists of a team of highly skilled lawyers with expertise in business registration and regulatory compliance. We are committed to providing our clients with the knowledge and resources necessary to navigate the complexities of company formation and ensure legal compliance throughout their business path.

We can help you with the following:

- Consulting on all matters that relate to company registration, identifying the advantages and limitations of different jurisdictions, as well as professional analysis in order to select the best option

- Legal documentation and company registration

- Company secretarial services

- Preparation of apostilled documents

- Ongoing legal support

Frequently asked questions

- How do I choose the most appropriate jurisdiction to incorporate my company?

- How much time does the company registration process take?

- Can I register a company online or do I need to visit state offices in person?

- What are the documents required to register a company?

- Can foreigners register a company in any other country?

- What are the costs of registering a company?

- What is the difference between a sole proprietorship, partnership, joint stock company and limited liability company?

- What are the post-registration compliance requirements?

- What are the possible consequences of failing to comply with company registration requirements?

- Which jurisdictions are the most popular for company registration?

- What advantages does Manimama Law Firm have over other law firms?

- How do I choose the most appropriate jurisdiction to incorporate my company?

Semen Kaploushenko

Deffio

|

CEO

“Great experience working with Manimama OU. Their team displayed in-depth knowledge of their field and provided professional legal support at every of our project.”

Vadym Hrusha

Trustee Plus

|

Founder & CEO

“When you become a client of Manimamа, you can count on not only that they will provide you with legal services, you can find a partner who will never abandon you if you have problems with a regulator or counterparty.”

Yuriy Soshenko

WhiteBit

|

CLO

“Team of Manimama OU quickly and accurately dealt with my case, provided clear recommendations, and helped me achieve my desired result.”

January / 30 / 2026

|

15 m. to read

Read

January / 28 / 2026

|

15 m. to read

Read

January / 23 / 2026

|

15 m. to read

Read

January / 21 / 2026

|

15 m. to read

Read

January / 19 / 2026

|

15 m. to read

Read

for crypto & fintech success

Tell us what you want to create. We will prepare a legal structure that ensures its implementation

Tokenization

Tokenization

Licensing

Incorporation

Other

.png)